As mentioned before, things between HYBE and ADOR settled a bit in terms of significant news for like a day, and as suspected that was because legal preparations were being made. HYBE recently announced formal accusations will be filed against Min Hee Jin and ADOR for occupational breach of trust.

——

HYBE claims they have obtained evidence through the audit that show Min Hee Jin and other ADOR executives planned to take over the company.

“One of the auditees submitted digital evidence containing information about the plan to seize management control and contact outside investors and admitted that they had written documents to attack HYBE during the investigation.

According to face-to-face investigations and the conversation record from the submitted digital evidence, the CEO of ADOR instructed the management team to devise ways to pressure HYBE to sell the ADOR shares it holds.”

The evidence reportedly includes proof that Min Hee Jin had been directing ADOR executives to research ways they could pressure HYBE into selling shares to ADOR, which they allegedly did.

“In response to this directive, specific discussions took place on ways to prematurely terminate exclusive contracts with artists and invalidate contracts between the CEO of ADOR and HYBE. Conversations such as, ‘pull in global funds and make a deal with HYBE,’ ‘critically counterattack everything HYBE does,’ and, ‘think of ways to torment HYBE’ also ensued.

The conversation record also contained execution plans such as ‘preparing for a battle of public opinion in May’ and ‘making ADOR an empty shell and taking it away.’

HYBE also obtained a statement from the auditee that ‘the wording ‘ultimately leaving HYBE’ was written exactly as what the CEO of ADOR said.'”

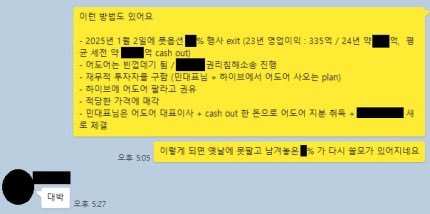

HYBE also released a convo from a group chat between three ADOR executives, including Min Hee Jin, which was noted as another option.

“-Put option __% exit on January 2, 2025 (2023 operating profit: 33.5 trillion won / 2024 approximately __ won, average pre-tax cash out of approximately __ won)

-ADOR becomes an empty shell / File a lawsuit for infringement of rights

-Seek financial investors (CEO Min + plan to buy out ADOR from HYBE)

-Suggest that HYBE sell ADOR

-Sold at a reasonable price

-CEO Min is the CEO of ADOR + acquires ADOR shares with the cashed out money + newly signs __ contract

If this happens, the leftover __% that wasn’t able to be sold in the past becomes useful again”

In response to that, Min Hee Jin herself replies with “daebak“.

Based on evidence such as that, HYBE has decided to make their legal move.

——

Well, the mess is officially here.

None of the evidence released so far looks good for Min Hee Jin and her executives, so it should be interesting to see what ADOR’s response is now.

Asian Junkie Asian pop. Without discretion.

Asian Junkie Asian pop. Without discretion.